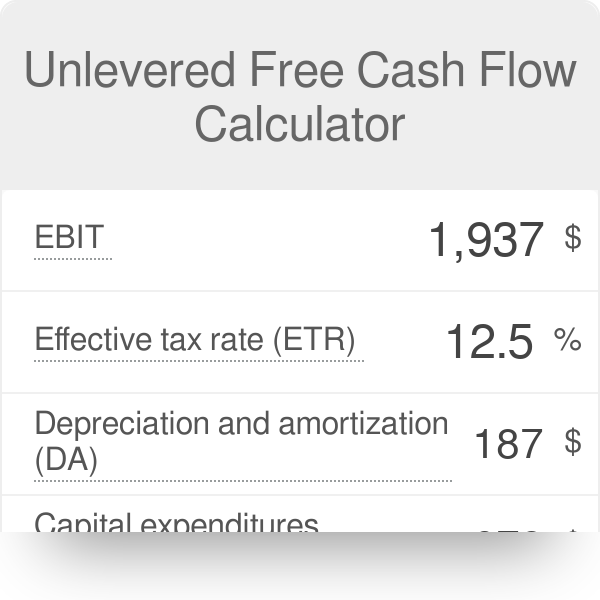

unlevered free cash flow calculator

In other words its a measure of how much cash. Start with Operating Income EBIT on the companys.

Fcf Yield Unlevered Vs Levered Formula And Calculator

A complex provision defined in section 954c6 of the US.

. It assumes a company is financed purely by equity. On the other hand unlevered free cash flow UFCF is the sum available before debt payments are made. Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this.

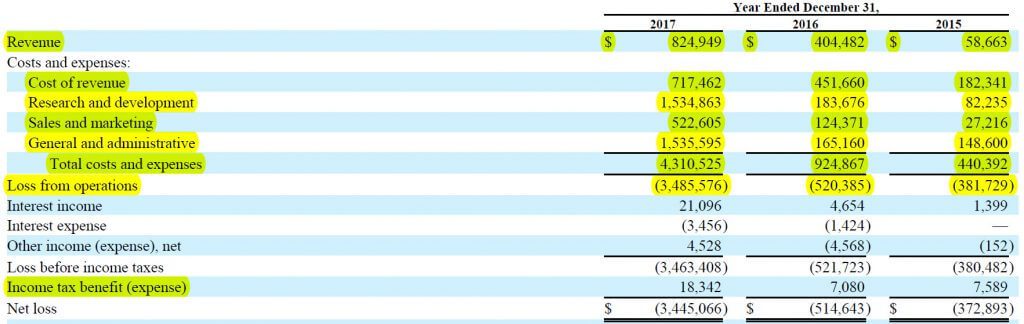

Unlevered free cash flow is the cash flow a business has excluding interest payments. Levered free cash flow is calculated as Net Income which already captures interest expense Depreciation Amortization - change in net working capital - capital. This is the cash flow that is reported in the financial.

Internal Revenue Code that lowered taxes for many US. Free cash flow to the firm is free cash flow excluding all debt financing ie. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account.

Unlevered Free Cash Flow - UFCF. So these are the. You can see the entire formula in Excel below.

The formula to calculate the unlevered free cash flow for a company is the following. Unlevered Free Cash Flow can be defined as the companys cash flow before they have taken interest payments into account. Essentially this number represents a companys financial status if they were to have no debts.

Unlevered FCF growth should slow down. Free Cash Flow to Firm FCFF Formula EBIT FCFF To calculate FCFF starting from earnings before interest and taxes we begin by adjusting EBIT for taxesEBIT is an unlevered profit. Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital.

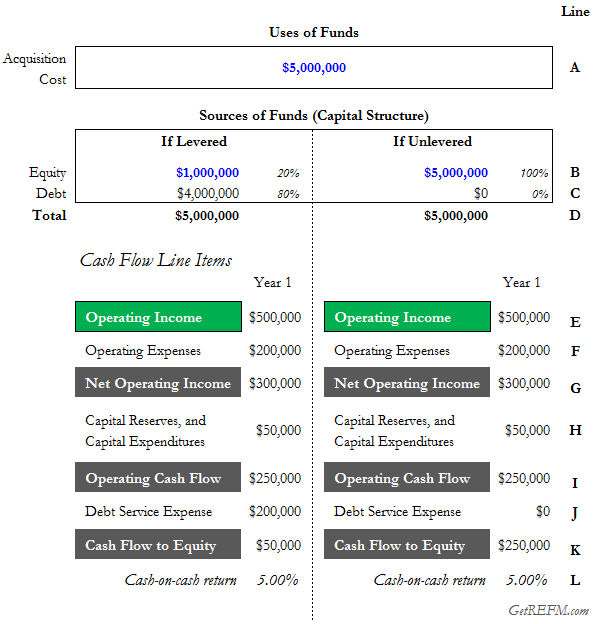

Both cash flows illustrate the. 5 Free Cash Flow to the Firm FCFF Free Cash Flow to the Firm or. The difference between levered and unlevered FCF is that levered free cash flow LFCF subtracts debt and interest from total cash whereas unlevered free cash flow UFCF leaves it in such.

Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx. Unlevered free cash flow. It is a measure that some financial institutions consider because it shows debt repayment capability.

A business or asset that. Unlevered Free Cash Flow. Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another.

Unlevered Free Cash Flow is the amount of cash flow a company generates after covering all expenses and necessary expenditures. FCFE Levered Free Cash Flow is used in financial modeling to determine the equity value of a firm. A companys unlevered free cash flow aka.

Unlevered free cash flow doesnt imply that a business wont meet its financial obligations but. Unlevered free cash flow removes all of these debt payments from the picture. Levered free cash flow includes operational costs while unlevered free cash flow provides a way to calculate without including expenses.

Looking at cash flow is a great way for investors to check the financial health of a business while calculating levered free cash flow is one of the most effective ways to determine. The difference between UFCF and LFCF is the financial obligations. Unlevered free cash flow is a financial metric used to calculate the cash generated by a business before taking interest and taxes into account.

The look thru rule. The handy unlevered free cash flow calculator helps determine the free cash available to the equity-holders and debt-holders. Levered free cash flow on the other hand works in favor of the.

Unlevered Free Cash Flow Formula. In this article we cover what the unlevered free cash flow is how to calculate it and a real-life example about how. FCFF EBIT 1-t Depreciation Capital Expenditure Change in non-cash.

Free Cash Flow Big Sale Off 79

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Formula Calculator Excel Template

Fcf Yield Unlevered Vs Levered Formula And Calculator

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

Unlevered Free Cash Flow Calculator Ufcf

Zaljenje Opisni Hendikep How To Calculate Free Cash Flow Yield Infinitymayfair Com

What Is Free Cash Flow And Why Is It Important Example And Formula Article

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda