pa unemployment income tax refund

Both federal and state law allow the department to intercept your federal income tax refund if your fault overpayment is due to under-reported or unreported earnings. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

Department Of Labor Admits It Overcharged Unemployed Pennsylvanians Millions Of Dollars Spotlight Pa

Ad File your unemployment tax return free.

. According to the IRS the refundable tax credit is 50 or 70 for wages paid during the first 3 quarters of 2021 of up to 10000 in wages paid by an eligible employer whose business has been financially impacted by COVID-19. For more information on myPATH. Get Information About Starting a Business in PA.

Under the new law taxpayers who earned less than 150000 in modified adjusted gross income can exclude some unemployment compensation from their income. Report the Acquisition of a Business. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

For Corporate Net Income Tax CNIT purposes the calculation of taxable income begins with federal taxable income. In Box 11 you will see the amount of state income tax that was withheld. The unemployment rate in Pennsylvania in May was 69.

Apply for a Clearance. Call the IRS at 1-800-829-1040 after February 23. Harrisburg PA With tax filing season underway the Department of Revenue is urging Pennsylvanians to file their tax returns as soon as they can.

Your full name and Social Security number should be entered on the check or money order to ensure it is able to be processed. Particularly for low-income residents. In Box 4 you will see the amount of federal income tax that was withheld.

You dont need to attach Form 1099-G to your Form 1040 or Form 1040-SR. Contact the IRS at 800-829-1040 to request a copy of your wage and income information. Mail the completed form to.

The department may file a lien against your real and personal property for a fault overpayment. Update Account Information eg. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion.

Will I Get An Unemployment Tax Refund. Communication Preference Email or US Mail Addresses telephone numbers email addresses. MyPATH functionality will include services for filing and paying Personal Income Tax including remitting correspondence and documentation to the department electronically.

No one claiming the ACTC Additional Child Tax Credit or EITC Earned Income Tax Credit has received or will receive a direct deposit before February 15th. To view and print your current or. Thats dictated by the PATH Act.

This tax form provides the total amount of money you were paid in benefits from the Office of Unemployment Compensation in 2021 as. Can I Get My Kentucky Unemployment W2 Online. People who received unemployment benefits last year and filed tax.

- Personal Income Tax e-Services Center. Harrisburg PA There are more than 118000 low-income Pennsylvanians who may be missing. PA Unemployment Compensation cannot be used as credit towards Local Earned Income Tax liability.

In Box 1 you will see the total amount of unemployment benefits you received. Dont expect a refund for unemployment benefits. Five Tax Tips on Unemployment Benefits.

Register for a UC Tax Account Number. Stimulus Unemployment PPP SBA. This is the fourth round of refunds related to the unemployment compensation exclusion provision.

Check For The Latest Updates And Resources Throughout The Tax Season. File and Pay Quarterly Wage and Tax Information. Change My Company Address.

Reemployment Trade Adjustment Assistance FP-1099G form The 1099G forms for Regular Unemployment Compensation UC is now available to download online. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. Learn More About UCMS.

This means they dont have to pay tax on some of it. Pennsylvania Personal Income Tax Guide Chapter 7. The Department of Revenue e-Services has been retired and replaced by myPATH.

If you are filing a paper return make sure that you have completed Lines 1 through 18 of your PA-40 PA Personal Income Tax Return before completing PA Schedule SP. Employee-directed contributions to retirement plans are taxable. Register to Do Business in PA.

Submit Amend View and Print Quarterly Tax Reports. 1099-G Tax Form Information you need for income tax filing T he Statement for Recipients of Certain Government Payments 1099-G tax forms are mailed by January 31 st of each year for Pennsylvanians who received unemployment benefits. Once the 2020 1099G forms are uploaded PUA claimants can access their PUA-1099G.

Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Click here for the Request for Change in Withholding Status form. Taxable and Nontaxable Income Page 27.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. Premium federal filing is 100 free with no upgrades for premium taxes. This is not a new thing weve been dealing with this since 2016.

The federal tax code counts jobless benefits as taxable income. Pennsylvania Department of Labor and Industry. Low-Income Pennsylvanians May Be Missing Out on PA Tax Refunds of 100 or More.

These refunds are expected to begin in May and continue into the summer. The Internal Revenue Service plans to send back money to 28 million Americans who filed taxes early before legislation that waived. All payments should be sent to.

Spotlight PA reported that numerous refunds exceeded 500 with some totaling thousands of. The Pandemic Unemployment Assistance PUA 1099G form will also be made available to download online. If you are single leave the space for spouse blank.

Stock Options are taxable. Begin completing Schedule SP by entering your name and your spouses name marital status and Social Security number s. 100 free federal filing for everyone.

PA Unemployment Tax Refund. The non-resident rate of the municipality in which you work. On Form 1099-G.

Make an Online Payment. Checks or money orders should be made payable to. Pennsylvania Department of Revenue.

Personal Income Tax. UCMS provides employers with an online platform to view andor perform the following. AB Dates of June 17 2012 or later have a ten-year recoupment period.

Office of Unemployment Compensation Benefits UI Payment Services PO Box 67503 Harrisburg PA 17106-7503. Appeal a UC Contribution Rate. Accessed April 17 2020.

Social SecurityMedicare Tax cannot be used as credit towards Local Earned Income Tax liability.

Why Is My Tax Refund Taking So Long Eyewitness News

Guidance For Unemployment Compensation Claimants Lower Bucks Times

Unemployment Recipients May Want To Wait To File Their 2020 Tax Returns

1099 G Tax Form Why It S Important

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Taxes And Unemployment Compensation What You Need To Know Before Filing Philadelphia Legal Assistance

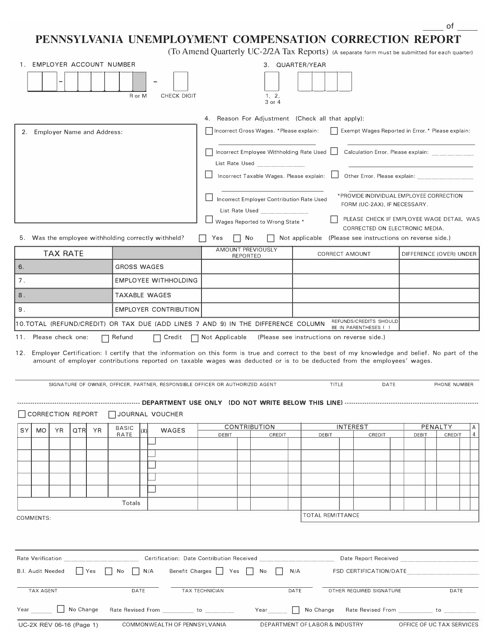

Form Uc 2x Download Printable Pdf Or Fill Online Pennsylvania Unemployment Compensation Correction Report Pennsylvania Templateroller

Another Blow To Working People During The Pandemic States Snatching Back Tax Refunds Center For Public Integrity

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

2022 2023 Tax Brackets Rates For Each Income Level

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post